💰 Would possibly perchance per chance also This Billionaire Set FTX?

November 10, 2022 / Unchained Day-to-day / Laura Shin

What’s Poppin’?

FTX Would possibly perchance per chance also goal File for Monetary catastrophe After Binance Walks Off the Deal

by Juan Aranovich

With out a bailout from Binance, FTX also can very nicely be forced to file for economic ruin. Enter Justin Sun.

FTX Wishes $8B to Meet Investor Withdrawals: Describe

by Samyuktha Sriram

Sam Bankman-Fried advised merchants that FTX would want $8 billion to satisfy withdrawal requests on Wednesday, the Wall Avenue Journal reported.

Tron Founder Justin Sun Says He Is Working With FTX on a Solution

by Samyuktha Sriram

A shock tweet from Justin Sun left users wondering whether he also can very nicely be the unlikely hero in crypto’s hour of need.

TRX Trades 1500% Greater on FTX After Justin Sun’s Proposed ‘Solution’

by Samyuktha Sriram

TRX traded at a premium on FTX after Justin Sun’s offer to redeem Tron linked tokens on a 1:1 basis.

US DOJ Joins SEC and CFTC Probe of FTX

by Samyuktha Sriram

The U.S. DOJ has joined the SEC and CFTC in an investigation into FTX’s practices.

FTX-Issued Wrapped Solana Tokens Would possibly perchance per chance also Add to DeFi Contagion: wBTC Creator

by Samyuktha Sriram

Solana DeFi people are insecure in regards to the outcomes of an unbacked wrapped SOL token and an impending token unstaking event on Thursday.

Sequoia Capital Writes Off $214M FTX Funding to Zero

by Samyuktha Sriram

Sequoia Capital marked down its entire FTX investment to zero, but maintained that its funds are aloof in factual form.

In Varied Info… ✍️✍️✍️

- Bankrupt crypto lender Celsius filed a circulate to extend the time it needs to put up a reorganization belief.

- Binance added more funds to its SAFU (Proper Asset Fund for Users), which acts as insurance for merchants’ cash.

- The U.S. Treasury Department sanctioned addresses which could perchance perchance be allegedly tied to the sale of unlawful medication.

- Crypto shopping and selling and lending firm Genesis Trading lost $7 million after hedging against market volatility.

- Maple Finance, an undercollateralized lending protocol, denied Alameda catch entry to to loans wait on in Would possibly perchance per chance also goal attributable to “weaknesses.”

This day in Crypto Adoption…

- MetaMask, the most sleek crypto wallet, launched a brand contemporary characteristic that will combination bridge services and products to transfer tokens at some level of diversified chains.

The $$$ Nook…

- Blockchain analytics firm TRM Labs raised $70 million in a Assortment B funding spherical.

- U.Okay.-primarily primarily based startup Ramp Community closed a $70 million Assortment B funding spherical co-led by Mubadala Capital and Korelya Capital.

What Sort You Meme?

Urged Reads

- Ryan Berckmans on why ETH could perchance perchance attain $20K

- Arthur Hayes, cofounder of Bitmex, on the collapse of FTX

- Chris Burniske, companion at Placeholder, on Solana and the market reaction

On The Pod…

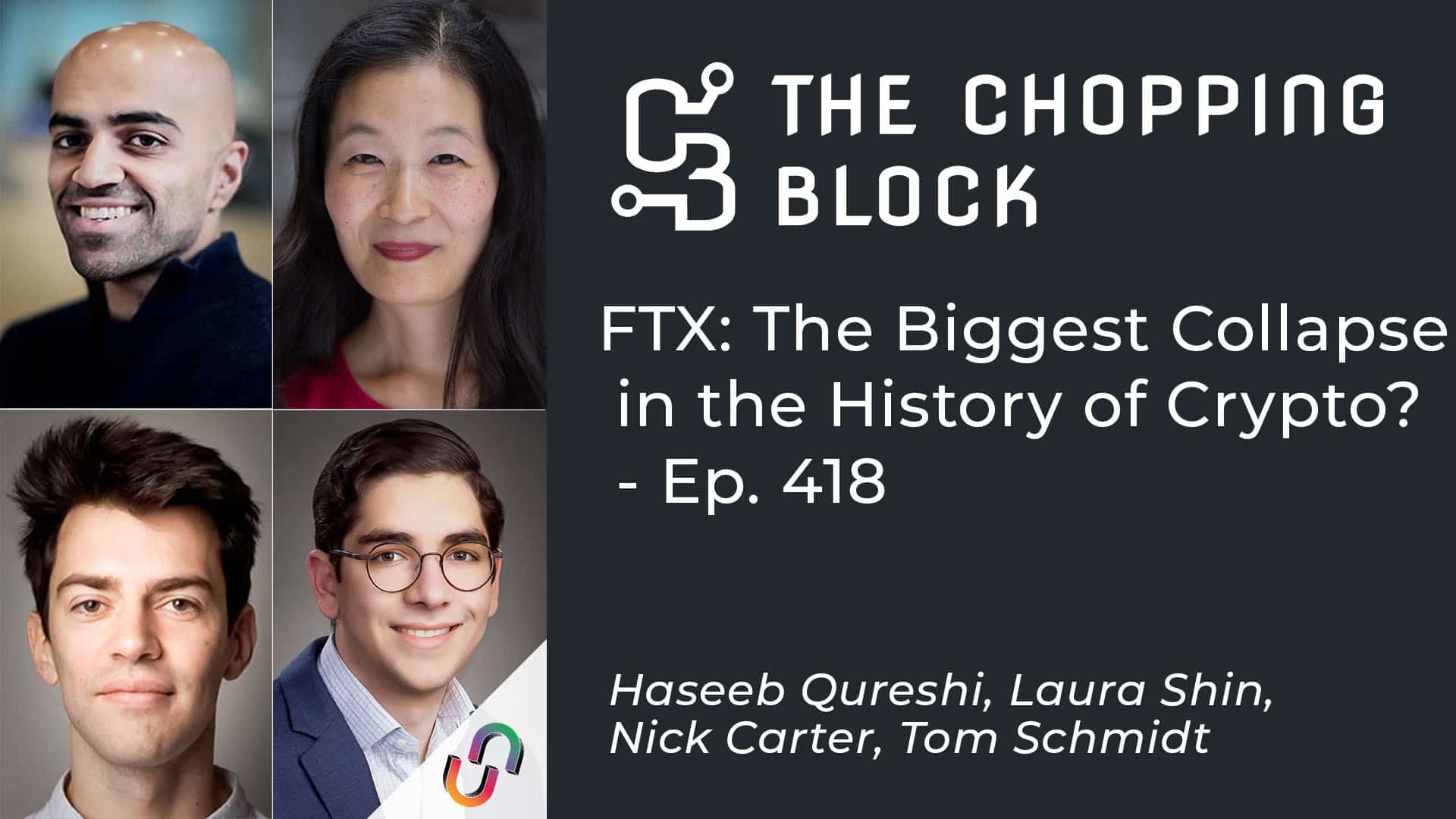

The Cutting Block: FTX: The Biggest Give arrangement in the Historic past of Crypto?

Welcome to The Cutting Block! Crypto insiders Haseeb Qureshi and Tom Schmidt had been joined by Nic Carter, reformed Bitcoin Maxi, and Laura Shin, CEO of the demonstrate, to gash it up about Binance’s buyout of FTX. Point out subject matters:

- Haseeb’s tl;dr of Binance’s conceivable acquisition of FTX

- whether Alameda is the contemporary Three Arrows Capital

- the implications of FTX’s collapse for regulators and lawmakers

- what is going to occur to the total agencies that lent cash to Alameda

- Sam Bankman-Fried’s emergency effort to take billions of dollars

- whether there also can very nicely be prison costs against FTX

- why FTX was as soon as no longer as winning as other spinoff exchanges

- what the odds are of Binance surely shopping for FTX

- whether the endeavor imprint of FTX is negative

- Tom’s concerns in regards to the focus in the switch

- how FTX’s implosion will impact crypto endeavor capital corporations

- whether Solana can live on with out SBF’s make stronger

- how the dearth of transparency kicked off this area and the arrangement in which blockchains support clear up this articulate of affairs

Book Update

My e book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Titanic Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You furthermore mght can gather it right here: https://amzn.to/3CvfrbE

Source credit : unchainedcrypto.com